how long can you go without paying property taxes in missouri

Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest and other charges. Depending on the state the redemption period might last from one year to three years.

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Can You Pay Property Taxes Monthly In Texas.

. Should you fall on hard times a loving family member or generous family friend can go to the tax office and pay the balance for you. In most states its an extremely short period of time. A delinquent is one who.

But you may ask what happens if you do file your taxes. How much money can you inherit without paying taxes on it. What Happens Once You Fall Behind on Your Property Taxes.

Why are property taxes so high in Long Island. 140150 140190. How Long Can You Go Without Filing a Tax Return.

When you lock in your rate ask your lender how long the lock is valid for. How Long Can You Go Without Paying Property Taxes In Texas. And the IRS will also impose interest and penalties for every year you do not file.

In 2022 the federal estate tax generally applies to assets over 1206 million. How Long Can You Go Without Paying Property Taxes In Texas. In some counties the time frame may vary from county to county.

If you dont pay your California property taxes you could eventually lose your home through a tax sale. As well some counties often consider how long the tax bill. A tax structure will depend on where the market is located.

But a sale cant happen until five years after the property is tax-defaulted. If you dont have this type of help and your taxes become delinquent the taxing authority may issue a tax lien on your home or sell the home at auction. If the property is not a homestead property however the original owner must buy back the deed and pay full penalties within six months.

Some states allow the property tax authority to foreclose on the home directly if taxes go unpaid. As we mentioned before when youre late on your property taxes interest and penalty fees can start adding up. If your home is sold for tax purposes you may redeem your home during the redemption period if the homeowner has the right to reside there.

Due dates typically follow in January. If you dont redeem the property by paying off the tax debt the purchaser from the auction can eventually. In most states you can buy back.

If your tax bill is not mailed out until after January 10 your delinquency date will get pushed out. This doesnt get you off the hook however. If the auctioned property is a homestead--meaning it was the primary place of residence for the owner--the owner can buy back his tax deed within two years from the date of the auction.

If you live in a county with 3000000 or more residents youll have to pay the taxes special assessments interest and costs due. If you cant make the payments your lender might foreclose on your property. This means that not filing taxes for 10 years may result in a huge amount of penalties.

You pay this tax when you own a home or other real property in a state or location that charges it. Property taxes are not paid monthly. What Is The Deadline To Pay Property Taxes In Texas.

What Are The Penalties For Paying Property Taxes Late. At the sale the winning bidder bids on the property and gets a certificate of purchase. How Long Can You Go Without Paying Property Taxes In Missouri.

If you dont pay the amount due the sheriff will likely hold a tax sale and sell the home to a new owner. A rate lock can be good for anywhere from 30 to 60 days which typically will give you enough time to close before the. Taxes vary according to what area of the country is taxed.

It takes a person 120 days or more to recover from this. In this case the new delinquency date would be March 1. Depending on the laws in your state an investor may come along and satisfy that lien.

A tax sale must happen within three years though state law permits an earlier sale if the taxes are delinquent. In this article youll learn what notice youll get before a California tax sale how the tax sale process works and whether you can. In Missouri any overdue property taxes automatically become a lien on your home.

Over 120 days are the maximum possible amount of time that this happens. For instance if the bill goes out on January 20 you wont get that 21-day window to pay by the 31st. If its not received by then you could start.

Always remember that for the IRS there is no time limit for collecting your taxes. You are responsible for paying your property taxes. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Paying property taxes on a monthly or yearly basis is generally considered a good idea. How Long Can You Go Without Paying Property Taxes In Missouri. Some can go as high as 24 depending on where you live.

At any time on or before the business day immediately before the sale you can pay the taxes and costs due which will stop the sale. Property values are high on the Island in part because Nassau and Suffolk are New York City suburbs. February is the deadline for taxes not paid on time.

In most states you can buy back your home after a tax sale by paying the buyer what he or she paid for the home or by paying the taxes owed plus interest. You should get your property tax bill in November and payment is due by January 31. Theyre usually paid biannually twice a year or annually.

There is no federal inheritance tax but there is a federal estate tax. When a home sells for the third time only the owner has 90 days to redeem the property. As for property taxes the homeowner forfeits the property to the agency in the second year of a tax delinquency.

In Michigan state law allows any public taxing agency -- state or local -- to claim a lien on property once 35 days have passed after a final bill is sent to the homeowner. In other states a property deed or lien cannot be auctioned if it. Your lender will add the taxes to your mortgage balance.

It typically takes one year for the Missouri court to determine who is charged.

Missouri Income Tax Rate And Brackets H R Block

Missouri Sales Tax Small Business Guide Truic

Missouri Sales Tax Guide For Businesses

Find Homes For Sale Market Statistics Foreclosures Property Taxes Real Estate News Agent Reviews Condos Find Homes For Sale Real Estate News Property Tax

Individual Income Tax Electronic Filing

Faq Categories Personal Property Tax Clay County Missouri Tax

Pay Property Taxes Online Jackson County Mo

How To Use The Property Tax Portal Clay County Missouri Tax

Missouri Estate Tax Everything You Need To Know Smartasset

Personal Property Tax Jackson County Mo

Missouri Mo State Tax Refund Status And Tax Brackets Taxact

Fill Free Fillable Forms For The State Of Missouri

Missouri Department Of Revenue Facebook

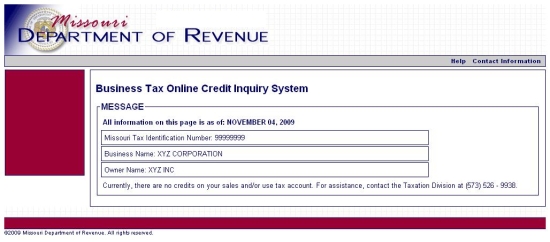

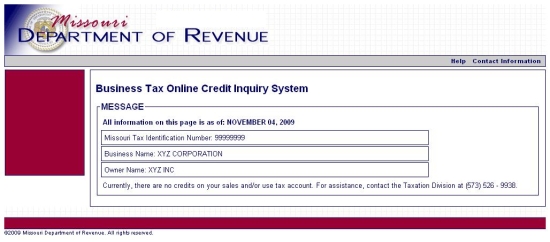

Sales Use Tax Credit Inquiry Instructions